Understanding the Punjab Revenue Authority Tax Schedule 2025

Contents

Understanding the Punjab Revenue Authority Tax Schedule 2025

Introduction

The Punjab Revenue Authority (PRA) has released an updated tax schedule for the year 2025, outlining tax rates and slabs for individuals and businesses. This article provides a comprehensive overview of the tax structure, helping taxpayers understand their obligations and plan accordingly.

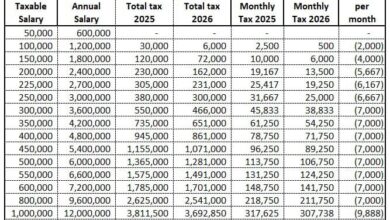

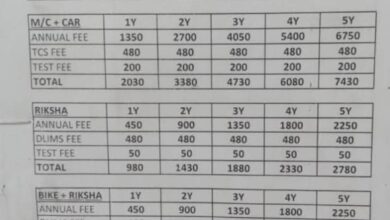

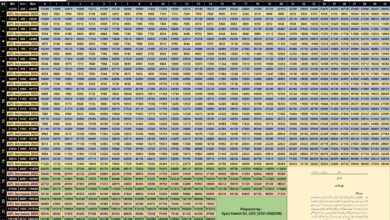

Tax Slabs and Rates

The tax schedule categorizes taxpayers into filers and non-filers, with different rates applied based on income levels. Below is a breakdown:

- Filer Category (1% Non Filer 2%)

- Income up to 500,000 PKR + 200,000-300,000 PKR: 0% tax

- Income up to 500,000 PKR + 200,000-300,000 PKR: 0% tax

- Income up to 500,000 PKR + 200,000-300,000 PKR: 0% tax

- Income above 500,000 PKR: 3% tax

- Income above 500,000 PKR: 3% tax

- Income above 350,000 PKR + 50,000 PKR: 5% tax

- Non-Filer Category

- Higher rates apply for non-filers, with a minimum tax of 1% on certain income thresholds.

Penalty and Additional Charges

- Late filing or non-compliance incurs penalties.

- Additional charges may apply based on the income bracket, with a minimum fine of 5000 PKR and a maximum of 1500 PKR for specific violations.

Table: Tax Rates Overview

| Income Range (PKR) | Filer Rate | Non-Filer Rate |

|---|---|---|

| Up to 500,000 + 200-300k | 0% | 1% |

| Above 500,000 | 3% | 3% + Penalty |

| Above 350,000 + 50,000 | 5% | 5% + Penalty |

FAQs

- What is the deadline for filing taxes in 2025?

- The deadline is April 30, 2025, as per the notice.

- Who qualifies as a filer?

- Individuals or businesses who have submitted their tax returns on time.

- What happens if I miss the filing deadline?

- A penalty ranging from 5000 PKR to 1500 PKR may be imposed, along with higher tax rates.

- How can I contact PRA for assistance?

- Call 042-111-22-22-77 or visit the nearest PRA office.

Conclusion

The Punjab Revenue Authority’s 2025 tax schedule emphasizes timely compliance to avoid penalties and higher tax rates. By understanding the slabs and rates, taxpayers can ensure accurate filing and contribute to the province’s revenue system effectively. Stay informed and plan your finances to meet these obligations by the deadline of April 30, 2025.