Income Tax Relief for Teachers and Researchers in 2025

Income Tax Relief for Teachers and Researchers in 2025

Introduction

In a significant move to support educators and researchers, the Finance Act 2025 has introduced a retroactive income tax relief for full-time teachers and researchers. This amendment, detailed in a recent circular (No. AC-1131/Tax/2024-25 dated 18.07.2025), restores tax deductions effective from 01.07.2022. This article explores the details, implications, and benefits of this tax relief, ensuring you stay informed about this financial support.

What is the New Tax Relief Policy?

The Finance Act 2025 has amended the Second Schedule of the Income Tax Ordinance, 2001, by inserting clause 3A, Part III. Key points include:

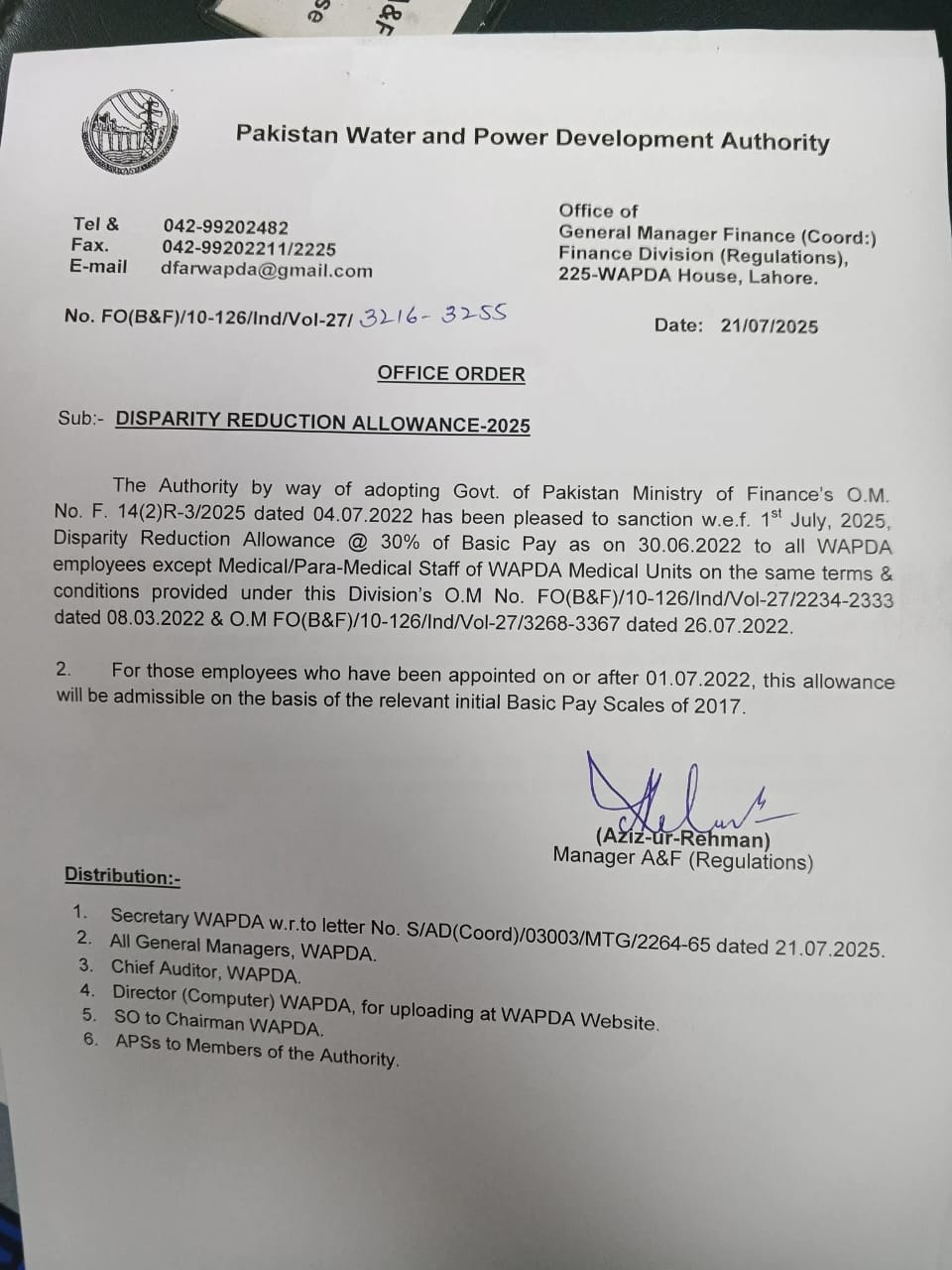

- Retroactive Effect: Tax relief is restored from 01.07.2022 and will continue post-tax year 2025.

- Target Beneficiaries: Full-time teachers and researchers employed in PAEC (Pakistan Atomic Energy Commission).

- Implementation: Local Accounts Offices are directed to ensure compliance starting 01.07.2025.

For more details, refer to the official Finance Act 2025 guidelines.

Benefits of Income Tax Relief

This policy brings several advantages:

- Financial Relief: Reduced tax liabilities for educators and researchers.

- Motivation Boost: Encourages professionals to pursue careers in teaching and research.

- Economic Impact: Supports the education sector, a critical pillar of national development.

Learn more about tax benefits in Pakistan on this resource.

Implementation Guidelines

Local Accounts Offices must:

- Ensure proper provision of tax relief as per the Finance Act, 2025.

- Advise full-time teachers and researchers to claim the relief.

- Maintain accurate records for compliance.

This directive, issued with the approval of the Member (Finance), underscores the government’s commitment to the education sector.

Table: Key Dates and Details

| Aspect | Details |

|---|---|

| Effective Date | 01.07.2022 (Retroactive) |

| Circular Issue Date | 18.07.2025 |

| Implementation Date | 01.07.2025 |

| Beneficiaries | Full-time Teachers & Researchers in PAEC |

Infographic Idea

FAQs

1. Who is eligible for this tax relief?

Full-time teachers and researchers employed by PAEC are eligible.

2. When does the tax relief start?

The relief is effective retroactively from 01.07.2022.

3. How can I claim this relief?

Contact your Local Accounts Office or refer to the PAEC guidelines.

4. Is this relief permanent?

It applies post-tax year 2025, subject to future amendments.

Conclusion

The income tax relief for teachers and researchers in 2025 is a welcome step towards recognizing the contributions of educators. By ensuring financial support, this policy aligns with global trends to bolster education, as seen in initiatives like those on UNESCO’s education support page. Stay updated and leverage this benefit to enhance your professional journey.

One Comment